In the world of banking, your resume serves as your first impression and, often, your only chance to stand out in the eyes of potential employers.

Whether you’re a seasoned banking professional or just starting your career in finance, crafting a compelling banking resume is essential to opening doors to lucrative opportunities.

This post will walk you through the key skills, strategies, and expert tips necessary to create a banking resume that not only highlights your qualifications but also sets you apart from the competition.

From understanding the intricacies of the banking industry to tailoring your resume for specific roles and acing interviews, I’ve got you covered.

Let me embark on a journey to unlock the secrets of a winning banking resume, ensuring that your career in finance reaches new heights.

If you want to search for schools near me, you can click saschoolsnearme

Understanding the Banking Industry

The banking sector is a multifaceted industry that plays a pivotal role in the global economy.

To craft an impressive banking resume, it’s crucial to have a comprehensive understanding of this dynamic field.

In this section, I’ll explore the different types of banking institutions and the overarching responsibilities of banking professionals.

A. Types of Banking Institutions

1. Commercial Banks

Commercial banks are the most recognizable face of the banking industry for the general public.

They offer a wide range of services to individuals, businesses, and government entities.

These services encompass everything from savings and checking accounts to loans, credit cards, and wealth management.

2. Investment Banks

Investment banks are financial intermediaries that primarily cater to corporations, institutions, and high-net-worth individuals.

They specialize in services such as mergers and acquisitions, capital raising, securities trading, and advisory services.

Unlike commercial banks, investment banks do not engage in traditional retail banking activities.

3. Credit Unions

Credit unions are member-owned financial cooperatives that provide banking services to their members.

They often offer competitive rates on savings and loans, striving to benefit their members rather than maximize profits.

B. Role of a Banking Professional

Regardless of the type of banking institution, professionals in the industry share common responsibilities:

- Client Services: Banking professionals are often the first point of contact for clients. They assist clients with various financial transactions, answer inquiries, and provide guidance on banking products and services.

- Financial Analysis: In-depth financial analysis is essential for assessing the creditworthiness of borrowers, evaluating investment opportunities, and managing risk effectively.

- Risk Management: Banking professionals must identify, assess, and mitigate various risks, including credit risk, market risk, and operational risk, to safeguard the financial stability of their institutions.

- Regulatory Compliance: The banking industry is heavily regulated to ensure stability and protect consumers. Professionals must stay updated on relevant laws and regulations, ensuring their institution’s adherence to compliance standards.

Understanding these fundamental aspects of the banking industry is the first step toward tailoring your resume effectively for a career in this dynamic field.

As I go deeper into this post, I’ll explore the specific skills and qualities that will make your resume shine in the eyes of potential employers.

Key Skills for a Banking Resume

When crafting your banking resume, it’s crucial to highlight the skills that make you a valuable asset to potential employers.

These skills can be broadly categorized into core banking skills and soft skills.

A. Core Banking Skills

1. Financial Analysis

- Financial Statement Analysis: Proficiency in analyzing financial statements to assess the financial health of clients or companies.

- Risk Assessment: The ability to identify and evaluate financial risks associated with lending or investment decisions.

- Credit Analysis: Expertise in assessing creditworthiness by reviewing credit reports and payment histories.

2. Risk Management

- Risk Mitigation: Demonstrated capability to implement risk mitigation strategies to protect the bank’s assets.

- Portfolio Diversification: Knowledge of diversifying portfolios to spread risk across various assets and investments.

- Stress Testing: Familiarity with stress testing to assess how the bank’s assets would perform under adverse economic conditions.

3. Regulatory Compliance

- Knowledge of Regulations: Understanding and adherence to banking regulations such as Basel III, Dodd-Frank, and Know Your Customer (KYC) regulations.

- Compliance Reporting: Proficiency in preparing compliance reports and ensuring the bank’s operations align with regulatory requirements.

- Anti-Money Laundering (AML): Awareness of AML protocols and the ability to detect and prevent money laundering activities.

B. Soft Skills

1. Communication

- Effective Communication: Strong verbal and written communication skills for interacting with clients, colleagues, and regulatory bodies.

- Client Relationship Building: The ability to establish and maintain positive relationships with clients through clear and empathetic communication.

2. Customer Service

- Client-Centric Approach: A commitment to delivering exceptional customer service and addressing client needs promptly.

- Problem-Solving: Strong problem-solving skills to resolve client issues efficiently.

3. Problem Solving

- Critical Thinking: The capacity to think critically and make informed decisions, especially in high-pressure situations.

- Adaptability: Flexibility to adapt to rapidly changing financial environments and market conditions.

These core banking skills and soft skills are essential to showcase on your resume.

Tailoring your resume to emphasize these competencies will make you a compelling candidate in the competitive banking industry.

In the following sections, I’ll go deeper into strategies for customizing your resume and highlighting your achievements to further enhance your job prospects.

Tailoring Your Resume

Creating a successful banking resume goes beyond listing your skills; it involves tailoring your document to match the specific requirements of the banking roles you’re targeting.

In this section, I’ll explore how to customize your resume for different banking positions and discuss key elements of resume formatting and structure.

A. Customizing for Different Banking Roles

1. Retail Banking

- Objective Statement: Tailor your resume’s objective statement to highlight your passion for delivering exceptional customer service.

- Key Skills: Emphasize skills such as client relationship building, problem-solving, and cross-selling financial products.

- Experience: Showcase any experience in retail banking, including roles like teller, personal banker, or branch manager.

2. Investment Banking

- Objective Statement: Focus on your financial acumen and your desire to work in a fast-paced, high-stakes environment.

- Key Skills: Highlight skills like financial analysis, mergers and acquisitions (M&A), and capital market expertise.

- Experience: Include internships, coursework, or any relevant experience that demonstrates your understanding of investment banking.

3. Mortgage Banking

- Objective Statement: Express your interest in the mortgage industry and your ability to guide clients through the home loan process.

- Key Skills: Showcase skills in mortgage origination, underwriting, and knowledge of relevant regulations.

- Experience: Highlight experience in mortgage processing, loan origination, or related roles.

B. Resume Formatting and Structure

1. Contact Information

- Professional Email: Use a professional email address that includes your name.

- LinkedIn Profile: Include a link to your LinkedIn profile if you have one, ensuring it’s complete and professional.

2. Resume Summary

- Tailored Objective: Customize your resume’s objective or summary statement to match the specific banking role you’re applying for.

3. Work Experience

- Relevance: Prioritize relevant work experience and quantifiable achievements in each role.

- Action Verbs: Use action verbs to describe your responsibilities and accomplishments.

4. Education and Certifications

- Relevant Education: Highlight degrees, courses, or certifications directly related to the banking sector.

- Certifications: Include certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), if applicable.

By tailoring your resume to the specific banking roles you’re interested in and ensuring a well-structured document, you’ll increase your chances of making a strong impression on hiring managers.

In the following sections, I’ll go into the finer details of showcasing your achievements and optimizing your resume for applicant tracking systems (ATS).

Showcasing Achievements

In the world of banking, it’s not enough to simply list your job responsibilities; you need to highlight your achievements and contributions to stand out.

This section will guide you on how to effectively showcase your accomplishments on your banking resume.

A. Using Metrics and Quantifiable Results

To demonstrate the impact of your work, consider these strategies:

1. Use Specific Numbers

- Instead of stating, “Managed client portfolios,” say, “Managed a portfolio of 50 high-net-worth clients with a total value exceeding $10 million.”

2. Highlight Revenue Generation

- If you contributed to revenue growth, quantify it. For example, “Generated $500,000 in new business through cross-selling financial products.”

3. Risk Mitigation

- Describe how you helped mitigate risks. For instance, “Reduced credit risk by 15% through comprehensive credit analysis.”

B. Highlighting Leadership and Teamwork

1. Leadership Roles

- If you held leadership positions, emphasize them. For example, “Led a team of 10 analysts in conducting market research and investment analysis.”

2. Team Achievements

- Showcase achievements as part of a team. Highlight how your collaboration contributed to successful outcomes.

3. Problem-Solving

- Share instances where your problem-solving skills played a critical role. For instance, “Resolved a complex client issue, saving a valuable account worth $1 million.”

4. Awards and Recognitions

- Mention any awards or recognitions you received in your banking career.

By quantifying your achievements and emphasizing your leadership and teamwork skills, you’ll paint a compelling picture of your contributions in your resume.

Remember, employers are not just looking for employees who can do the job; they want candidates who can excel and drive positive results.

In the upcoming sections, I’ll explore the importance of using relevant keywords and optimizing your resume for Applicant Tracking Systems (ATS).

Keywords and Phrases

In today’s digital job market, many employers use Applicant Tracking Systems (ATS) to screen resumes.

To ensure your banking resume passes through these systems and reaches human eyes, it’s essential to include relevant keywords and phrases.

A. Utilizing Industry-Specific Keywords

1. Tailor Keywords to the Job Description

- Review the job posting and identify keywords and phrases used by the employer.

- These are typically the skills, qualifications, and experience they’re seeking.

2. Core Banking Terms

- Include industry-specific terms like “credit analysis,” “financial modeling,” “portfolio management,” and “compliance.”

3. Job Titles

- If the job posting mentions specific job titles (e.g., “Financial Analyst,” “Loan Officer”), ensure they appear in your resume.

B. Applicant Tracking Systems (ATS) and Resume Optimization

1. Use Synonyms

- ATS systems can recognize synonyms, so use variations of relevant keywords. For example, if “Risk Management” is a keyword, also include “Risk Mitigation” and “Risk Control.”

2. Avoid Overstuffing

- While keywords are important, avoid overloading your resume with them. Maintain a natural and readable flow.

3. Context Matters

- Incorporate keywords within the context of your achievements and experiences. Don’t simply list keywords without substance.

4. Customize for Each Application

- Tailor your resume’s keyword section for each job application to align with the specific requirements of the role.

By incorporating these industry-specific keywords and optimizing your resume for ATS, you increase your chances of getting noticed by potential employers.

In the upcoming sections, I’ll explore the importance of professional networking, crafting effective cover letters, and avoiding common resume mistakes.

Professional Networking

In the banking industry, professional networking can be a powerful tool for career growth and advancement.

Building meaningful connections within the industry can lead to valuable opportunities, insights, and support.

This section outlines how to leverage professional networking effectively.

A. Leveraging LinkedIn and Other Platforms

1. Create an Impressive LinkedIn Profile

- Complete Profile: Ensure your LinkedIn profile is comprehensive, featuring a professional photo, detailed work experience, and an engaging summary.

- Connections: Connect with professionals in your field, including colleagues, mentors, and industry influencers.

- Participate in Groups: Join relevant LinkedIn groups and participate in discussions to showcase your expertise.

2. Networking Events and Associations

- Industry Events: Attend banking and finance conferences, seminars, and networking events in your area. These provide opportunities to meet professionals and stay updated on industry trends.

- Industry Associations: Join banking associations like the American Bankers Association (ABA) or local banking associations to access networking opportunities and resources.

- Chamber of Commerce: Consider becoming a member of your local chamber of commerce, which often hosts events that attract professionals from various industries.

B. Networking Etiquette

1. Be Proactive

- Initiate conversations and connections with professionals you admire or who work in roles you aspire to.

2. Elevator Pitch

- Prepare a concise and engaging elevator pitch that describes your background, skills, and career goals.

3. Offer Value

- Networking is a two-way street. Offer assistance, share insights, and provide value to your network whenever possible.

4. Follow Up

- After networking events or connecting online, send follow-up messages expressing your gratitude and interest in maintaining the connection.

Professional networking not only helps you stay informed about industry developments but can also open doors to job opportunities and career growth.

In the next section, I’ll go into crafting effective cover letters tailored to the banking industry.

Cover Letters for Banking Resumes

While your resume is a crucial tool for showcasing your qualifications, a well-crafted cover letter can provide a more personal and persuasive introduction to potential employers.

In the field of banking, a strong cover letter can set you apart from other candidates.

Here are some key considerations when writing a cover letter for your banking resume:

A. Purpose and Importance

1. Introduction

- Start your cover letter with a clear and concise introduction that includes your name, the position you’re applying for, and how you learned about the job opening.

2. Express Your Interest

- Express genuine interest in the position and the company. Explain why you’re excited about the opportunity and how your skills align with the role.

3. Personalize Each Letter

- Customize each cover letter for the specific job application. Mention the company’s name and any relevant details from the job posting.

B. Crafting an Effective Banking Cover Letter

1. Highlight Relevant Experience

- Expand on your resume by discussing specific experiences and accomplishments that make you a strong candidate for the position.

2. Showcase Skills

- Emphasize key skills that are vital in the banking industry, such as financial analysis, risk management, and customer service.

3. Address Gaps

- If you have employment gaps or other potential concerns in your resume, use the cover letter to provide context or address them positively.

4. Conclude Professionally

- Close the cover letter by expressing your eagerness for an interview, your availability for further discussion, and a polite thank-you for considering your application.

5. Proofread

- Thoroughly proofread your cover letter to ensure it’s free from errors in grammar, spelling, and punctuation.

Your cover letter should complement your banking resume by providing a narrative that highlights your qualifications and demonstrates your enthusiasm for the role.

In the following sections, I’ll discuss common resume mistakes to avoid and provide tips on preparing for banking interviews.

Resume Mistakes to Avoid

Creating an impressive banking resume involves not only showcasing your skills and achievements but also avoiding common resume pitfalls that can diminish your chances of landing your desired job.

Be vigilant about these resume mistakes:

A. Common Resume Pitfalls

1. Spelling and Grammar Errors

- Careless typos, misspellings, and grammatical mistakes can create a negative impression. Proofread your resume thoroughly or consider using a professional proofreading service.

2. Irrelevant Information

- Keep your resume focused on relevant skills and experiences. Exclude personal information, unrelated hobbies, or outdated achievements.

3. Exaggeration

- Be honest about your qualifications and achievements. Exaggerating or falsifying information can damage your reputation if discovered.

4. Lengthy Resumes

- Your resume should be concise and relevant. Avoid including every job you’ve ever had; instead, prioritize recent and significant experiences.

B. Overcoming Resume Gaps

1. Employment Gaps

- Address employment gaps in your cover letter by providing a brief explanation. Focus on any skills you acquired or activities you pursued during the gap that are relevant to the job.

2. Frequent Job Changes

- If you’ve changed jobs frequently, provide explanations in your cover letter and emphasize transferable skills gained from each role.

3. Lack of Keywords

- Ensure your resume includes relevant keywords and phrases from the job description. This helps your resume pass through applicant tracking systems (ATS).

By avoiding these common resume mistakes and addressing any employment gaps or job changes professionally, you’ll present a well-crafted resume that stands out to potential employers.

In the next section, I’ll discuss strategies for preparing effectively for banking interviews, a crucial step in securing a banking position.

Preparing for Banking Interviews

The interview stage is a critical step in securing a banking position.

It’s your opportunity to showcase your skills, experience, and personality to potential employers.

Effective preparation can significantly increase your chances of success in banking interviews.

A. Researching the Company

1. Company Overview

- Thoroughly research the bank or financial institution you’re interviewing with. Understand their history, mission, values, and recent news or developments.

2. Industry Insights

- Stay informed about current trends and challenges in the banking industry. Be ready to discuss how these factors may impact the bank and your potential role.

3. Interviewers

- If you know the names of your interviewers in advance, research their backgrounds and roles within the organization.

B. Common Interview Questions and Answers

1. Behavioral Questions

- Be prepared to answer behavioral questions that assess your past experiences, such as “Can you describe a time when you had to resolve a conflict within a team?”

2. Technical Questions

- Brush up on technical knowledge relevant to your role, such as financial analysis techniques, risk management strategies, or regulatory compliance.

3. Scenario-Based Questions

- Practice answering situational questions, which may ask how you would handle hypothetical challenges or scenarios in the workplace.

C. Practice and Mock Interviews

1. Mock Interviews

- Consider arranging mock interviews with a career coach, mentor, or trusted colleague to simulate real interview conditions.

2. STAR Method

- Familiarize yourself with the STAR (Situation, Task, Action, Result) method for answering behavioral questions effectively.

D. Questions for the Interviewer

1. Prepare Questions

- Have insightful questions ready for the interviewer. For example, you might ask about the bank’s growth strategy or the team’s key priorities.

2. Show Enthusiasm

- Demonstrate your enthusiasm for the role and the organization by asking questions that reflect your genuine interest.

E. Dress and Punctuality

1. Dress Professionally

- Choose appropriate attire that reflects the professional standards of the banking industry.

2. Arrive Early

- Plan to arrive at the interview location well in advance to account for any unforeseen delays.

F. Follow-Up

1. Send a Thank-You Email

- Send a polite and timely thank-you email to your interviewers, expressing your gratitude for the opportunity and reaffirming your interest in the position.

Effective preparation and a confident, well-informed approach can help you excel in banking interviews.

By showcasing your skills, industry knowledge, and enthusiasm, you’ll be well on your way to a successful banking career.

In the next section, I’ll provide banking resume samples and analyze key aspects of each sample to offer further guidance.

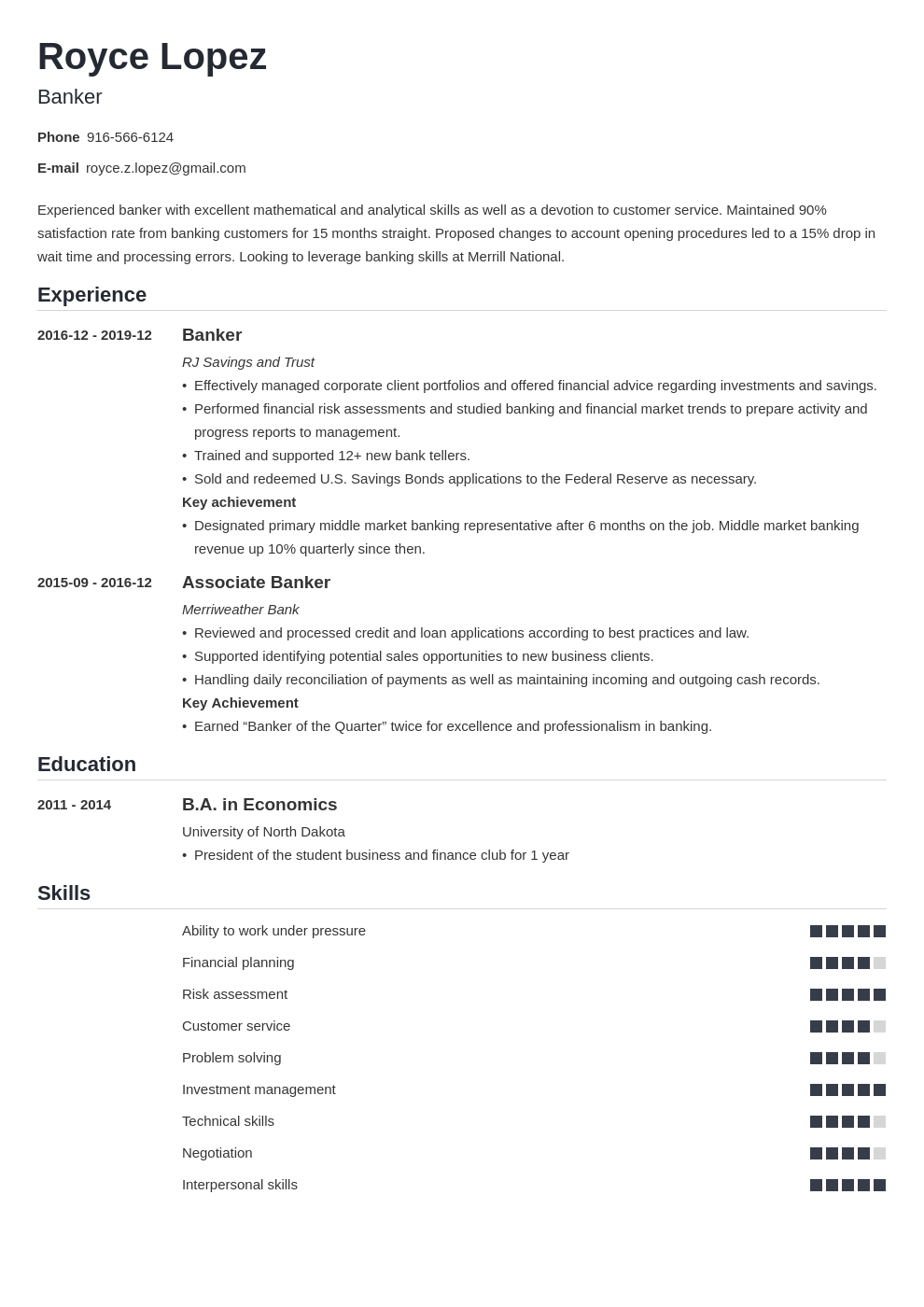

Banking Resume Sample Outline

- Contact Information

- Include your name, phone number, professional email address, and LinkedIn profile URL (if applicable).

- Resume Summary or Objective

- Write a brief, attention-grabbing summary or objective statement tailored to the specific job you’re applying for. Highlight your key qualifications and career goals.

- Core Competencies

- Create a section to list essential banking skills, such as financial analysis, risk management, regulatory compliance, and proficiency in financial software.

- Professional Experience

- List your work experience in reverse chronological order (most recent job first). Include the following for each position:

- Job Title

- Company Name and Location

- Employment Dates

- Key Responsibilities (use action verbs)

- Achievements (quantify whenever possible)

- List your work experience in reverse chronological order (most recent job first). Include the following for each position:

- Education

- Mention your highest level of education, including the degree earned, institution name, location, and graduation date.

- Certifications

- Highlight any relevant certifications, such as CFA (Chartered Financial Analyst) or CPA (Certified Public Accountant).

- Professional Affiliations

- If you’re a member of banking or financial associations, list them here.

- Skills

- Include a section that outlines both technical and soft skills pertinent to the banking industry, such as financial modeling, credit analysis, communication, and leadership.

- Languages

- If you’re proficient in multiple languages and it’s relevant to the position, mention them here.

Sample Accomplishment Statements

- “Led a team of three analysts in conducting comprehensive financial analysis, resulting in a 12% increase in the bank’s investment portfolio’s ROI.”

- “Managed a $10 million portfolio of high-net-worth clients, consistently exceeding quarterly sales targets by 20%.”

- “Implemented cost-saving strategies in risk management procedures, resulting in a 15% reduction in operational risk incidents.”

Remember to tailor your resume to the specific banking role you’re applying for.

Use the keywords and phrases from the job description, and quantify your achievements wherever possible to demonstrate your impact.

Use a clean and professional format with consistent font styles and bullet points to make your resume easy to read.

Feel free to ask if you have any specific questions or need further guidance on a particular aspect of your banking resume.

Essential resume tips

Certainly, here’s a summary of the essential tips for creating an effective banking resume:

- Start Strong: Begin with a clear and compelling resume summary or objective statement that grabs the employer’s attention and highlights your career goals.

- Tailor Your Resume: Customize your resume for the specific banking role you’re applying for, emphasizing relevant skills, experience, and keywords from the job description.

- Highlight Achievements: Use quantifiable metrics to showcase your accomplishments, emphasizing how you added value to your previous roles.

- Emphasize Key Skills: Include both core banking skills (e.g., financial analysis, risk management) and soft skills (e.g., communication, leadership) to demonstrate your well-rounded abilities.

- Include Certifications: Mention any relevant certifications, such as CFA or CPA, to bolster your qualifications.

- Professional Networking: Leverage platforms like LinkedIn and participate in industry events and associations to build a strong professional network in the banking sector.

- Effective Cover Letters: Craft personalized cover letters that express your enthusiasm for the position and elaborate on your qualifications.

- Avoid Common Resume Mistakes: Proofread rigorously to eliminate errors, keep your resume concise, and address employment gaps or job changes professionally.

- Prepare for Interviews: Research the company, practice answers to common interview questions, and arrive well-dressed and punctual for interviews.

- Follow Up: After interviews, send thank-you emails to express your gratitude and reiterate your interest in the role.

By following these essential tips, you’ll be well-equipped to create a compelling banking resume and navigate the job application process successfully.

What are 3 qualities a banker should have?

In the world of finance, bankers play a pivotal role in managing large sums of money and handling sensitive financial information.

To excel in this profession, they must possess a unique blend of qualities that set them apart.

In this section, I will explore three indispensable qualities that every exceptional banker should possess: Integrity, Communication Skills, and Problem-Solving Abilities.

These qualities not only define a banker’s success but also contribute significantly to the overall growth and stability of the financial institutions they serve.

Integrity: The Bedrock of Banking

Integrity, often hailed as the cornerstone of banking, is a quality that cannot be compromised.

Bankers deal with finances, investments, and loans, which demand the highest level of trustworthiness and ethical conduct.

Without integrity, the financial world would crumble.

In the realm of banking, integrity manifests in several ways:

1. Trustworthiness in Decision-Making

An exceptional banker always places the interests of their clients and the bank above all else.

They make sound decisions, even if it means refusing a loan application from a customer who doesn’t meet the criteria, knowing it might affect their commission.

This unwavering commitment to doing what’s right is a testament to their integrity.

2. Transparency in Actions

Transparent dealings are a hallmark of integrity.

Exceptional bankers keep their actions and transactions crystal clear, ensuring there’s no room for doubt or suspicion.

Clients should have complete confidence that their financial matters are handled honestly.

Communication Skills: Bridging the Gap

Banking is not just about numbers; it’s also about relationships.

To thrive in this field, communication skills are indispensable.

Bankers need to convey complex financial concepts in a way that clients can comprehend.

They must communicate effectively with various stakeholders, including clients, colleagues, and managers.

Here’s how communication skills come into play:

1. Simplifying Complexity

Exceptional bankers possess the ability to explain intricate financial products and services in simple, jargon-free language.

When discussing investment strategies or loan options, they ensure that clients fully grasp the implications.

2. Clear and Concise Reports

In the banking world, reports and documentation are part and parcel of daily operations.

Exceptional bankers excel in producing clear and concise reports, enabling managers and clients to make informed decisions swiftly.

Problem-Solving Skills: Navigating Challenges

The financial landscape is riddled with challenges, from economic downturns to individual financial crises.

Exceptional bankers shine in these situations, showcasing their problem-solving skills.

Here’s how they demonstrate this quality:

1. Assisting Clients in Distress

When clients face financial hardships, an exceptional banker steps in to find solutions.

Whether it’s renegotiating loan terms or devising a new payment strategy, they navigate through adversity to ensure their clients’ financial well-being.

2. Boosting Bank Profits

Banks are profit-driven entities, and bankers contribute significantly to their success.

Exceptional bankers use their problem-solving abilities to identify opportunities for growth and devise strategies to increase profits, benefiting both the bank and its clients.

How to make resume for bank job fresher?

Contact Information

- Include your full name, email address, phone number, and mailing address at the top of your resume. Make sure this information is current and professional.

2. Professional Summary or Objective

- Write a concise professional summary or objective statement. This should briefly describe your background, skills, and what you’re seeking in a bank job.

- Example: “Recent graduate with a Bachelor of Commerce degree seeking an entry-level position in the banking industry. Eager to contribute my strong analytical and communication skills in a dynamic and growth-oriented banking environment.”

3. Hard and Soft Skills

- List both your hard and soft skills relevant to the banking industry.

- Hard skills may include proficiency in financial analysis, Excel, banking software, or compliance procedures.

- Soft skills encompass interpersonal skills, teamwork, adaptability, and problem-solving abilities.

4. Educational Qualifications

- Detail your educational background, starting with your most recent degree.

- Include the name of the institution, the degree earned (e.g., Bachelor of Commerce), and the dates you attended.

- Mention any relevant coursework or academic achievements.

5. Internships and Projects

- Highlight any internships or projects related to finance or banking.

- Describe your responsibilities, achievements, and skills developed during these experiences.

- Emphasize how these experiences have prepared you for a role in the banking industry.

6. Awards and Achievements

- Showcase any awards, honors, or achievements you’ve received during your academic or extracurricular activities.

- This demonstrates your dedication and high-achieving nature.

7. Proofreading

- Carefully proofread your resume to eliminate grammar and spelling errors.

- Consider asking a trusted friend or family member to review it as well to ensure accuracy and clarity.

Additional Tips for Crafting Your Resume

- Keep your resume concise and limit it to one page.

- Use clear and straightforward language; avoid jargon or overly complex terminology.

- Focus on the most relevant skills and experiences for the specific bank job you’re applying for.

- Provide specific examples to illustrate your skills and achievements.

- Customize your resume for each job application to align with the job description and requirements.

FAQs

Certainly, here are some frequently asked questions (FAQs) related to banking resumes and job applications:

1. What are the essential skills for a banking resume?

- Essential skills for a banking resume include financial analysis, risk management, regulatory compliance, communication, customer service, problem-solving, and proficiency in financial software. Tailor your skills to match the specific job requirements.

2. How can I tailor my resume for different banking roles?

- Tailoring your resume involves customizing it for the specific banking position you’re applying for. Highlight relevant skills, experiences, and achievements that align with the job description. Use keywords from the job posting to enhance your resume’s relevance.

3. What are the common mistakes to avoid in a banking resume?

- Common resume mistakes to avoid include spelling and grammar errors, including irrelevant information, exaggerating qualifications, creating overly lengthy resumes, and not addressing employment gaps or frequent job changes effectively.

4. How do I prepare for a banking interview?

- To prepare for a banking interview, research the company, industry trends, and the role you’re applying for. Practice answering common interview questions, emphasize your achievements, and use the STAR method for behavioral questions. Dress professionally, arrive on time, and send a thank-you email after the interview.

These FAQs cover some of the key aspects of creating a banking resume and navigating the job application process in the banking industry.

If you have additional questions or need further guidance, feel free to ask.

Conclusion

In conclusion, crafting an effective banking resume and successfully navigating the job application process in the banking industry require careful planning and attention to detail.

By following the essential tips outlined in this comprehensive guide, you can increase your chances of standing out as a strong candidate:

- Start Strong: Begin with an engaging resume summary or objective statement.

- Tailor Your Resume: Customize your resume for the specific banking role you’re pursuing.

- Highlight Achievements: Emphasize quantifiable accomplishments to demonstrate your value.

- Emphasize Key Skills: Showcase both core banking and soft skills relevant to the position.

- Include Certifications: Mention any pertinent certifications to bolster your qualifications.

- Leverage Networking: Build a professional network through platforms like LinkedIn and industry events.

- Craft Effective Cover Letters: Write personalized cover letters that express your enthusiasm and qualifications.

- Avoid Resume Mistakes: Proofread thoroughly and address any employment gaps or job changes professionally.

- Prepare for Interviews: Research, practice, and present yourself professionally during interviews.

- Follow Up: Express gratitude and continued interest through post-interview thank-you emails.

By implementing these strategies and maintaining a commitment to professional growth, you can enhance your prospects for a successful banking career.

Remember that continuous learning and adaptability are key in an ever-evolving industry.

Best of luck in your pursuit of a rewarding banking career!

ALSO SEE;

Skills To Put On A Basic Resume

Skills To Put On A Business Resume

Skills To Put On A College Resume

Skills To Put On A Construction Resume

Skills To Put On A Resume For Caregiver